Returning Expert Programme

What is the Returning Expert Programme?

The Returning Expert Programme (REP) facilitates Malaysian professionals returning home from abroad to meet the talent needs of Malaysia. If you are planning your return home to utilise your global expertise towards the growth of Malaysia's economy, find out how we can make your journey home smoother while enjoying special incentives.

REP Incentives

Optional 15% flat tax rate on chargeable employment income for a period of five consecutive years.

DEDUCTION OF 15% FLAT TAX RATE

Agency

Inland Revenue Board (IRB)

Purpose

To exercise the 15% deduction on employment income.

Please refer to Lembaga Hasil Dalam Negeri (LHDN) for more information.

Related Document

EA Form

NOTES

- PCB will be deducted at 15% by the employer within the approval period subject to applicant’s decision on utilisation of the incentive.

- 15% will be taxed from the annual chargeable income after the submission of tax returns.

- If there is any surplus paid to IRB, the amount will be refunded to the applicant.

Exemption on import duty and excise duty for the purchase of one (1) fully imported Complete Built Up (CBU) vehicle or excise duty exemption for the purchase of one (1) locally manufactured Complete Knocked Down (CKD) vehicle, subject to the total duty exemption limit of up to RM100,000.

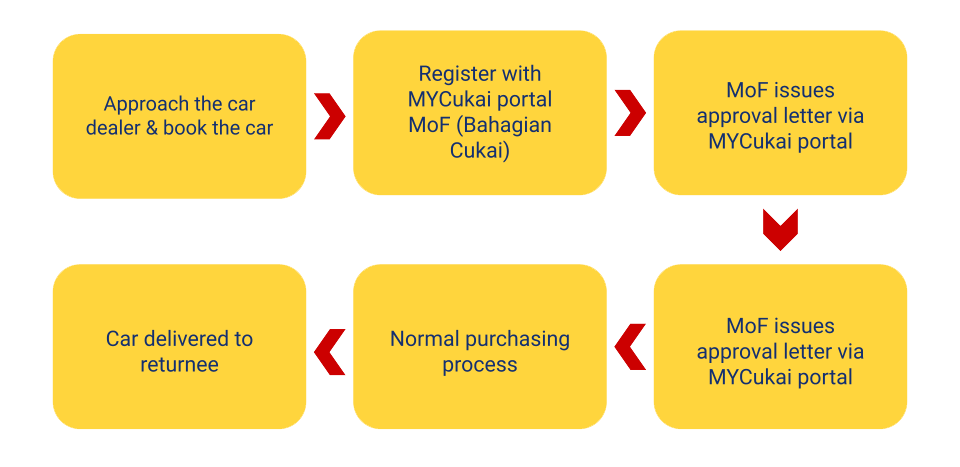

CLAIMING THE TAX-FREE CKD/CBU CARS

Agency

Tax Analysis Division (Bahagian Analisa Cukai), Ministry of Finance (MoF)

Purpose

Exemption on import duty and excise duty for the purchase of one (1) fully imported Complete Built Up (CBU) vehicle or excise duty exemption for the purchase of one (1) locally manufactured Complete Knocked Down (CKD) vehicle, subject to the total duty exemption limit of up to RM100,000.

Related Document

Register for an account at the MoF’s MyCukai portal to submit your form online. Click here for the link.

CKD & CBU Car Tax Incentive

The car must be delivered before the expiry date & the entire process may take up to 4 months.

For those approved under the revised incentive, if the taxes for the car totals above RM100,000.00, the tax exemption process MUST be done manually.

- Foreign spouses and children (below 18 years old) are eligible to apply for the Permanent Resident (MyPR) status.

- Applicants and foreign spouses must be married before the date of the REP application submission.

- This MyPR status is only applicable for Peninsular Malaysia.

NOTES

The procedure for Entry Permit issuance is subject to approval and at the discretion of the Director General of the Immigration Department of Malaysia while the procedure of MyPR issuance is subject to approval and at the discretion of the Director General of the National Registration Department of Malaysia.

Agency

Immigration Department of Malaysia

Purpose

Fast tracking of Entry Permit status of foreign spouses / children.

Related Document

Borang Permohonan Permit Masuk IM.4 Pin1/93

NOTES

- Approved applicant must obtain a valid Approval Letter, Surat Akuan Tarikh Kembali and support letters from Talent Corporation Malaysia Berhad (TalentCorp).

- MyPR application must be submitted at the Immigration Department Headquarters in Putrajaya.

- Approved applicant and dependent are required to be present at the Immigration Department Headquarters in Putrajaya.

- Application for Entry Permit will be processed at the discretion of the Immigration Department of Malaysia.

- MyPR application must be personally submitted to:

Jabatan Imigresen Malaysia Bahagian Visa, Pas dan Permit Tingkat 3 (Podium), Persiaran Perdana Presint 2, Pusat Pentadbiran Kerajaan Persekutuan 62550 PUTRAJAYA

*For more information, please engage with Bahagian Visa, Pas dan Permit, Jabatan Imigresen Malaysia.

Agency

National Registration Department of Malaysia

Purpose

Fast tracking of Permanent Resident (MyPR) status of foreign spouse / children.

Related Document

MyPR application form JPN.KP01.

NOTES

- Applicant must be present at the National Registration Department (NRD) Headquarters in Putrajaya or the State National Registration Department Headquarters with the required documents for submission (both original and copied/duplicates).

- Please complete the JPN.KP01 application form (available at the NRD counter).

- Applicant must apply for MyPR within 30 days from the reference date on Entry Permit issued by the Immigration Department of Malaysia (oval stamp). Applications submitted after 30 days will be charged with a processing fee.

- MyPR application must only be submitted to the NRD in Putrajaya or State NRD Headquarters:

National Registration Department (HQ), Aras 2, Bahagian Kad Pengenalan, No. 20, Persiaran Sultan Sallahuddin Abdul Aziz Shah, Presint 2, 62551 Wilayah Persekutuan Putrajaya

Note: No application can be submitted at other JPN branches. - Application for MyPR will be processed at the discretion of the National Registration Department of Malaysia.

*For more information, please engage with MyPR Division, Seksyen Semakan Taraf, Bahagian Kad Pengenalan, JPN Malaysia.

Under the REP, you are eligible to enjoy tax exemption for all personal effects brought into Malaysia (limited to one shipment).

Agency

Royal Malaysian Customs Department

Purpose

To obtain the tax exemption of personal effects brought into Malaysia.

Related Document

The Declaration of Goods Imported form – Borang Kastam No.1 – can be obtained from the Royal Malaysian Customs Department.

NOTES

Personal effects (more than 3 months in possession) encompass furniture and fittings, electronic and other general household items. Alcohol, tobacco and motorised vehicles does not fall under the incentives.

Relocating home can be rewarding

Malaysia's Returning Expert Programme (REP) is designed to celebrate and reward your professional journey as you bring your valuable expertise back home. This is more than a homecoming; it's a chance to infuse your career with new meaning while enjoying exclusive benefits. Join us on this enriching voyage and let's make a transformative impact together.

Eligibility criteria for the REP

To be considered for the Returning Expert Programme, you must first fulfil the following criteria:

General Requirements

- A citizen of Malaysia.

- Currently residing abroad and have been employed abroad continuously for a minimum of three years at the time of your REP application.

- Have not earned employment income in Malaysia continuously for a minimum of three years prior to your REP application.

- REP application is submitted prior to your return to Malaysia.

- Do not hold any outstanding scholarship bonds or loans with the Malaysian Government or any of its agencies.

- Under no obligation to return to Malaysia (if returning with the same company).

NOTES

Your REP application must be submitted while you are still residing and working abroad. Submissions that are made by applicants after they have returned to Malaysia will not be entertained.

Other requirements for all sectors (except healthcare)

Applications will also be evaluated based on the following requirements:

Diploma

- 12 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

Bachelor’s Degree

- 8 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

Master’s Degree / Full Membership With a Professional Body

- 5 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

PhD

- 4 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

- Other healthcare professionals, e.g. pharmacists, nurses and allied health practitioners are subject to the eligibility criteria for general professionals as well as registration requirements set by the respective professional bodies/regulators, such as the Pharmacy Board Malaysia and Malaysian Nursing Board.

- Baseline REP criteria still applies. Additionally, specialists would require different periods of supervised work experience as prescribed by the relevant NSR Specialist Committee. Details are available at https://www.nsr.org.my/criteria.html

Other requirements for healthcare sectors

Applications will also be evaluated based on the following requirements:

Bachelor’s Degree

- 8 years from the date of full professional registration of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

- Registered with MMC/MDC

Master’s Degree / Full Membership With a Professional Body

- Cumulative working experience abroad as required for registration with NSR

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

- Registered with MMC/MDC (mandatory)

- Registrable with NSR (mandatory)

- Other healthcare professionals, e.g. pharmacists, nurses and allied health practitioners are subject to the eligibility criteria for general professionals as well as registration requirements set by the respective professional bodies/regulators, such as the Pharmacy Board Malaysia and Malaysian Nursing Board.

- Baseline REP criteria still applies. Additionally, specialists would require different periods of supervised work experience as prescribed by the relevant NSR Specialist Committee. Details are available at https://www.nsr.org.my/criteria.html

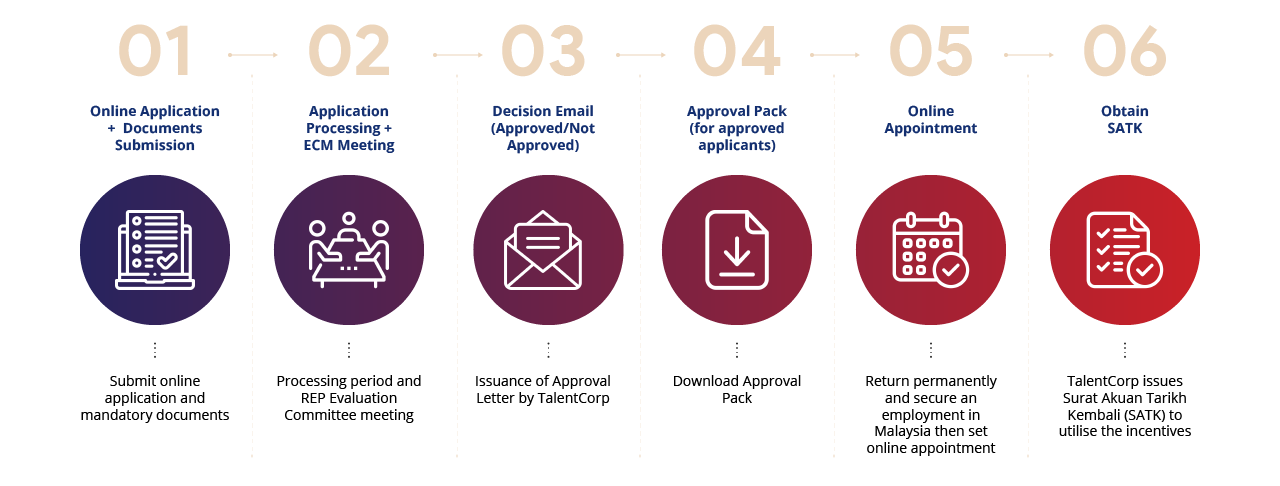

How to apply REP?

Application Procedure – General Guidelines

- You can apply for the REP at REP by TalentCorp. You have to first register for an REP account, then complete the online form, and finally upload all required documents as stipulated in the REP’s Terms and Conditions.

- Once your application is complete (including required documents), you will receive an acknowledgement email from the REP Secretariat. Your application will take approximately 45 working days to be processed. During this period, your application will be tabled to the REP Committee for consideration.

- The REP Committee will either approve or reject your application. You will receive a Decision Email from the REP Secretariat, informing you of the outcome.

- If your application is approved, you have a 2-year period from the date of the approval to return to Malaysia.

- Upon your return, you are required to schedule an online appointment with TalentCorp to provide further documents (listed in the Terms and Conditions) for confirmation. Once all documentations are in order, TalentCorp will issue a Surat Akuan Tarikh Kembali (“SATK”) in your favour.

- The SATK can be used to claim all REP incentives that you are eligible for.

Application Procedure – Required Documents

You will need the following documents for your application:

- A copy of your valid passport;

- A copy of your overseas residence document (permanent resident identity card, work permit or employment pass);

- Your latest resume (indicating years, months, and locations of current and previous employer(s));

- An offer letter or other equivalent agreement or document from your current employer (as proof of employment commencement date);

- Your latest salary slip (proof of employment at the time of application), or employment confirmation on join date, position, and salary;

- Your latest tax returns (salary reference if you have no fixed income);

- Your academic certificates that are certified by the Commissioner of Oath;

- Your employment offer letter or other equivalent agreement or document from Malaysia (if any);

- Valid and latest residing documents (proof of property ownership abroad and utility bills, or rental agreement and rental payment receipt) – only for applicants from Singapore, Thailand, and Brunei; and

- A copy of entry and exit stamps in your passport.

Additional documents for Self-Employed applicants

- Your business registration document (indicating when the business was established, and your names listed as the owner / board of director to the company);

- Your company’s bank statement for at least 6 months prior to the date of your submitted application, indicating receipt of payments to the business;

- A third-party confirmation that the business is still active until at least the time of your REP application from a company secretary, an external accountant, the Commissioner of Oath, or a Public Notary appointed by the government (to indicate that you are drawing an income at the time of application).

Doctors / Specialists

- Your complete registration certificate, duly approved by the Malaysian Medical Council. For registration, please refer to https://mmc.gov.my/

- Your complete registration certificate, duly approved by the National Specialist Registrar. For registration (specialists only), please refer to https://www.nsr.org.my/home.html

Dentist / Nurse / Other allied health practitioners

- Your registration from respective national professional bodies or regulators (e.g. Malaysian Nursing Board, Malaysian Dental Council).

MyHeart Partners