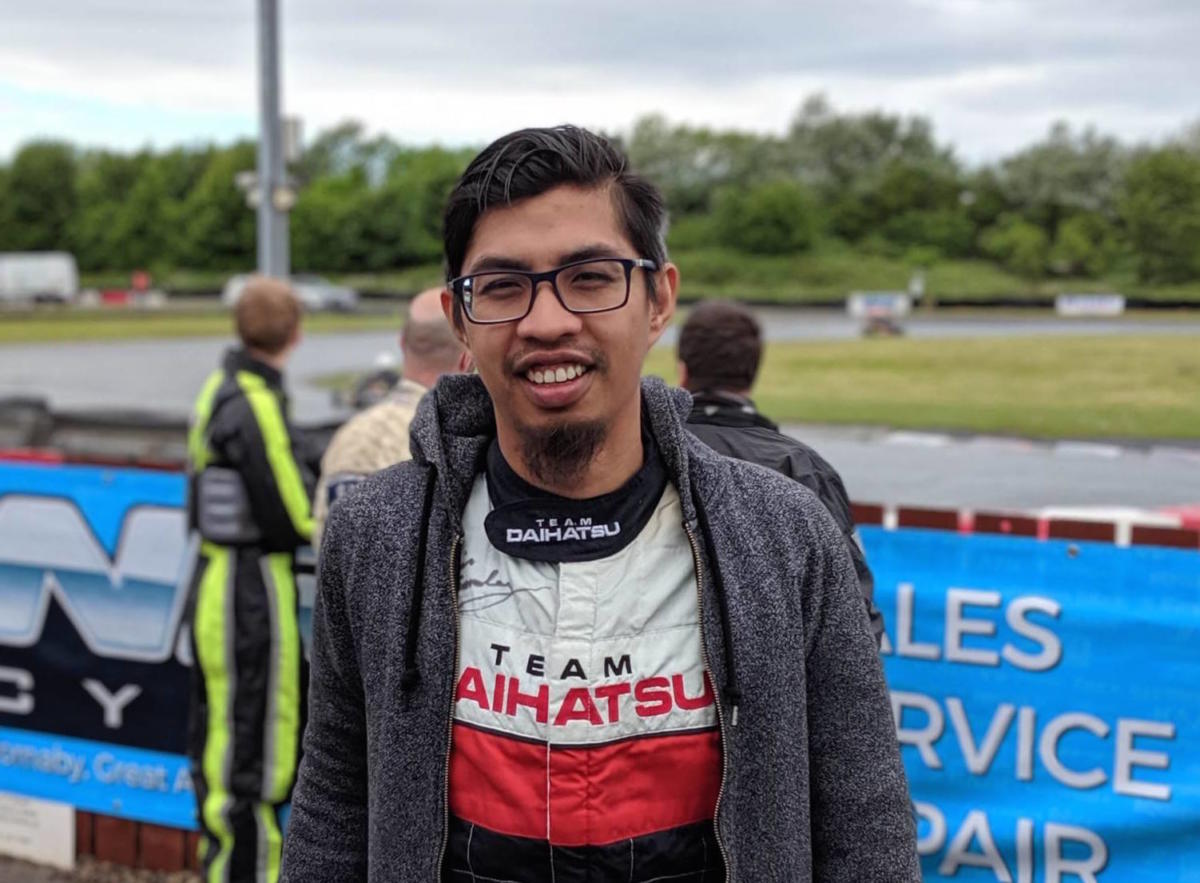

When Lim Say Cheong departed to Dubai in 2007, he could not have foreseen that it would mark the beginning of an illustrious international career in Islamic finance. Over the next two decades, he would go on to lead high-impact roles in Abu Dhabi and Saudi Arabia, build cross-border financial partnerships and rise to the helm of Saudi Venture Capital.

Today, Lim is not only a respected figure in the Gulf’s financial ecosystem, but also an advocate for Malaysia’s leadership in Islamic finance on the global stage.

A Chance Opportunity Turned Career Breakthrough

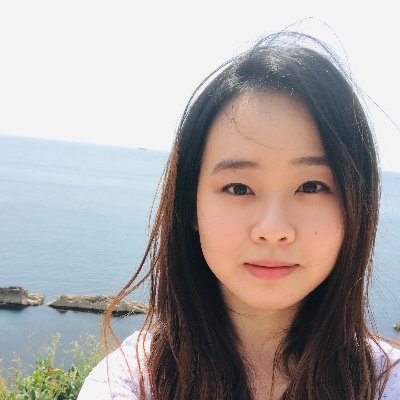

Lim’s journey in Islamic finance began by chance, despite having no formal background in the field. He earned a Bachelor of Science in Mathematics and Econometrics from the University of Sydney, followed by a Master’s in Financial Planning from the University of the Sunshine Coast. In 2007, he was hired by Dubai’s Noor Islamic Bank to lead its enterprise risk management division. A year later, he moved to Abu Dhabi to join Al Hilal Bank, where he spearheaded its investment banking arm.

Despite initial scepticism from Shariah scholars about his appointment, Lim was eventually approved by the board—the first of many breakthroughs that would come to define his career.

“I had to work twice as hard to prove I was up to the task,” Lim recalled. “Driven by both passion and fear, I immersed myself in Islamic finance, learning from scholars, earning certifications and applying what I learned across various roles.”

Today, Lim is the CEO of Saudi Venture Capital, where he provides advisory work across private equity and venture capital. His two-decade career has seen him master the full spectrum of Islamic finance, from sukuk structuring to Takaful and Shariah-compliant asset management.

Collaborating Across Borders

Despite having worked abroad for nearly two decades, Lim has continued to foster connections and collaborations with Malaysians and Malaysian entities. Over the years, he has worked on sukuk transactions worth hundreds of millions of dollars, often involving Malaysian institutions such as Bank Negara Malaysia, Employees Provident Fund (EPF), Kumpulan Wang Persaraan (KWAP), Tabung Haji and Hong Leong Islamic Bank.

“These partnerships are not just professional exchanges; they’re built on mutual respect and years of trust,” he shares. In one example, Lim facilitated a joint sukuk restructuring between a Saudi entity and Hong Leong Islamic Bank. More recently, he has initiated strategic discussions on a tokenisation project involving Shariah-compliant digital gold with stakeholders in Malaysia, including Labuan Financial Services Authority and several Islamic banks.

He is also a familiar face in Malaysia’s diplomatic and trade circles in the Gulf, often working with Malaysia External Trade Development Corporation (MATRADE), the Malaysian Business Council in Dubai and the embassies in the UAE and Bahrain.

Clinching a Prestigious Islamic Studies Fellowship

To add to an already impressive résumé, Lim recently beat out thousands of applicants worldwide to clinch a spot in the prestigious 2025–2026 Chevening-Oxford Centre for Islamic Studies (OCIS) Fellowship. It is a significant milestone for a Malaysian, and especially notable given Lim’s non-Muslim background.

“To make it this far is something I’ll always cherish,” Lim says. “I was surprised when I was shortlisted, let alone selected. This fellowship is a testament not just to my own work, but also to Malaysia’s standing in the global Islamic finance community.”

He had known about the fellowship for years, but long believed it was out of reach. “I used to think it was only meant for scholars and long-time academics. I never considered applying,” he admitted. Things changed in 2025, however, when he received encouragement from his peers and sensed that the timing was finally right. With that, he finally submitted his application.

Months later, he was invited for an interview with the British High Commission in Kuala Lumpur. “That’s when it really hit me. Out of thousands of applicants, I was one of five shortlisted. That I made it this far, and as a non-Muslim, is something I remain deeply proud of.”

Once his fellowship kicks off in October 2025, Lim will focus on researching green sukuk, a Shariah-compliant financial instrument designed to support environmentally and socially responsible projects. “While green sukuk is gaining traction in Malaysia and the Gulf, the adoption of ESG—especially the ‘S’ and ‘G’—remains inconsistent,” he explains. “Through my research, I hope to show how green sukuk can become a flagship instrument that aligns Islamic finance with sustainability and ethical investing.”

A Call to Globalise Malaysia’s Role

Sharing his observations on the Islamic finance landscape in Malaysia, Lim noted that Malaysia has long been a pioneer in this field, pointing out that it is known for its robust regulatory frameworks and collaboration between financial institutions and Shariah scholars.

To maintain its stronghold, Lim suggested that the nation can globalise its footprint by offering capital, knowledge and capacity to regions with prominent Muslim populations, like Central Asia and Africa.

Lim also emphasised the importance of Malaysia accelerating its digitalisation and tokenisation, as doing so would ensure the country remains at the forefront of financial technology.

Cultivating the Next Generation

Beyond strategic collaborations and impactful research, Lim is also passionate about education and mentorship. He has taught transformational leadership for Royal Brunei Airlines and Brunei Methanol Company and is preparing to deliver a two-day module at Cambridge University on data-driven leadership for Islamic finance professionals.

“One of my goals is to pay it forward,” he says. “There’s a dire need to upskill Malaysia’s workforce, especially in areas like artificial intelligence (AI), data analytics and blockchain. These are not just trends; they are the next frontier for Islamic finance.”

Next, Lim truly hopes to re-establish ties with Malaysia’s academic institutions and offer his expertise back home. “I’d love to help deepen Malaysia’s pool of talent, particularly by mentoring and teaching.”

To young Malaysians hoping to build an international career in Islamic finance, Lim has this advice: “Master the fundamentals. It’s not enough to understand Shariah principles in a Malaysian context. You need to know how they’re applied in different jurisdictions like Dubai, Bahrain or London. Get certified, build your global exposure and actively seek opportunities, be it internships, conferences or professional bodies.”

“Also, don’t be afraid to post your insights and thoughts on LinkedIn. It helps build your brand. And if you can, find a mentor who believes in your growth.”

Are you a Malaysian abroad with a passion for building global bridges in your field? Join MyHeart to connect with like-minded individuals dedicated to growing Malaysia’s presence on the world stage.