Returning Expert Programme

What is the Returning Expert Programme?

The Returning Expert Programme (REP) facilitates Malaysian professionals returning home from abroad to meet the talent needs of Malaysia. If you are planning your return home to utilise your global expertise towards the growth of Malaysia's economy, find out how we can make your journey home smoother while enjoying special incentives.

REP Incentives

Optional 15% flat tax rate on chargeable employment income for a period of five consecutive years.

DEDUCTION OF 15% FLAT TAX RATE

Agency

Inland Revenue Board (IRB)

Purpose

To exercise the 15% deduction on employment income.

Please refer to Lembaga Hasil Dalam Negeri (LHDN) for more information.

Related Document

EA Form

NOTES

- PCB will be deducted at 15% by the employer within the approval period subject to applicant’s decision on utilisation of the incentive.

- 15% will be taxed from the annual chargeable income after the submission of tax returns.

- If there is any surplus paid to IRB, the amount will be refunded to the applicant.

Exemption on excise duty for the purchase of one (1) locally manufactured Complete Knocked Down (CKD) vehicle, subject to a total duty exemption limit of up to RM100,000.

CLAIMING THE CKD CAR TAX FREE

Agency

Tax Division (Bahagian Cukai), Ministry of Finance (MoF)

Purpose

Exemption on excise duty for the purchase of one (1) locally manufactured Complete Knocked Down (CKD) vehicle subject to the total duty exemption limited up to RM100,000.

Related Document

Register for an account with MoF MyCukai portal to submit your form online. Click here for the link.

CKD Car Tax Incentive

The car must be delivered before the expiry date & the entire process may take up to 4 months.

For those approved under the revised incentive, if the taxes for the car totals above RM100,000.00, the tax exemption process MUST be done manually.

- Foreign spouses and children (below 18 years old) are eligible to apply for the Permanent Resident (PR) status.

- Applicants and foreign spouses must be married before the date of the REP application submission.

- This Permanent Resident (PR) status is only applicable for Peninsular Malaysia.

NOTES

The procedure for Entry Permit issuance is subject to approval and at the discretion of the Director General of the Immigration Department of Malaysia while the procedure of MyPR issuance is subject to approval and at the discretion of the Director General of the National Registration Department of Malaysia.

Agency

Immigration Department of Malaysia

Purpose

Entry Permit status of foreign spouses / children.

Related Document

Borang Permohonan Permit Masuk IM.4 Pin1/93 can be obtained from TalentCorp.

NOTES

- Approved applicant must obtain a valid Approval Letter, Surat Akuan Tarikh Kembali and support letters from Talent Corporation Malaysia Berhad (TalentCorp).

- Permanent Resident (PR) application must be submitted at the Immigration Department Headquarters in Putrajaya.

- Approved applicant and dependent are required to be present at the Immigration Department Headquarters in Putrajaya.

- Application for Entry Permit will be processed at the discretion of the Immigration Department of Malaysia.

- Permanent Resident (PR) application must be personally submitted to:

Jabatan Imigresen Malaysia Bahagian Visa, Pas dan Permit Tingkat 3 (Podium), Persiaran Perdana Presint 2, Pusat Pentadbiran Kerajaan Persekutuan 62550 PUTRAJAYA

*For more information, please engage with Bahagian Visa, Pas dan Permit, Jabatan Imigresen Malaysia.

Agency

National Registration Department of Malaysia

Purpose

Permanent Resident (MyPR) status of foreign spouse / children

Related Document

MyPR application form JPN.KP01.

NOTES

- Applicant must be present at the National Registration Department (NRD) Headquarters in Putrajaya or the State National Registration Department Headquarters with the required documents for submission (both original and copied/duplicates).

- Please complete the JPN.KP01 application form (available at the NRD counter).

- Applicant must apply for MyPR within 30 days from the reference date on Entry Permit issued by the Immigration Department of Malaysia (oval stamp). Applications submitted after 30 days will be charged with a processing fee.

- MyPR application must only be submitted to the NRD in Putrajaya or State NRD Headquarters:

National Registration Department (HQ), Aras 2, Bahagian Kad Pengenalan, No. 20, Persiaran Sultan Sallahuddin Abdul Aziz Shah, Presint 2, 62551 Wilayah Persekutuan Putrajaya

Note: No application can be submitted at other JPN branches. - Application for MyPR will be processed at the discretion of the National Registration Department of Malaysia.

*For more information, please engage with MyPR Division, Seksyen Semakan Taraf, Bahagian Kad Pengenalan, JPN Malaysia.

Under the REP, you are eligible to enjoy tax exemption for all personal effects brought into Malaysia (limited to one shipment).

Agency

Royal Malaysian Customs Department

Purpose

To obtain the tax exemption of personal effects brought into Malaysia.

Related Document

The Declaration of Goods Imported form – Borang Kastam No.1 – can be obtained from the Royal Malaysian Customs Department.

NOTES

Personal effects (more than 3 months in possession) encompass furniture and fittings, electronic and other general household items. Alcohol, tobacco and motorised vehicles does not fall under the incentives.

Relocating home can be rewarding

Malaysia's Returning Expert Programme (REP) is designed to celebrate and reward your professional journey as you bring your valuable expertise back home. This is more than a homecoming; it's a chance to infuse your career with new meaning while enjoying exclusive benefits. Join us on this enriching voyage and let's make a transformative impact together.

Eligibility criteria for the REP

To be considered for the Returning Expert Programme (REP), you must first fulfil the following criteria:

General Requirements

- A Malaysian citizen

- Currently residing abroad and has been employed abroad continuously for a minimum of three years at the time of REP application

- Has not earned employment income in Malaysia continuously for a minimum of three years prior to REP application

- REP Application is made prior to returning to Malaysia.

- Do not hold any outstanding scholarship bond or loan with the Malaysian government and its agencies.

- Under no obligation to return to Malaysia (if returning with the same company).

NOTES

Your REP applications should be submitted while the applicant is still residing and working abroad. Submissions made by applicants upon their return to Malaysia will not be considered.

ANNOUNCEMENT

Updated Eligibility Clarification for inter-company transfers within the same corporate group under the Returning Expert Programme (REP).

Other requirements for all sectors (except healthcare)

Applications will also be evaluated based on the following requirements:

Diploma

- 12 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

Bachelor’s Degree

- 8 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

Master’s Degree / Full Membership With a Professional Body

- 5 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

PhD

- 4 years of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

- Other healthcare professionals, e.g. pharmacists, nurses and allied health practitioners are subject to the eligibility criteria for general professionals as well as registration requirements set by the respective professional bodies/regulators, such as the Pharmacy Board Malaysia and Malaysian Nursing Board.

- Baseline REP criteria still applies. Additionally, specialists would require different periods of supervised work experience as prescribed by the relevant NSR Specialist Committee. Details are available at https://www.nsr.org.my/criteria.html

Other requirements for healthcare sectors

Applications will also be evaluated based on the following requirements:

Bachelor’s Degree

- 8 years from the date of full professional registration of cumulative working experience abroad

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

- Registered with MMC/MDC

Master’s Degree / Full Membership With a Professional Body

- Cumulative working experience abroad as required for registration with NSR

- An equivalent of RM20,000 or more in monthly salary earned while working abroad

- Registered with MMC/MDC (mandatory)

- Registered with NSR (mandatory)

- Other healthcare professionals, e.g. pharmacists, nurses and allied health practitioners are subject to the eligibility criteria for general professionals as well as registration requirements set by the respective professional bodies/regulators, such as the Pharmacy Board Malaysia and Malaysian Nursing Board.

- Baseline REP criteria still applies. Additionally, specialists would require different periods of supervised work experience as prescribed by the relevant NSR Specialist Committee. Details are available at https://www.nsr.org.my/criteria.html

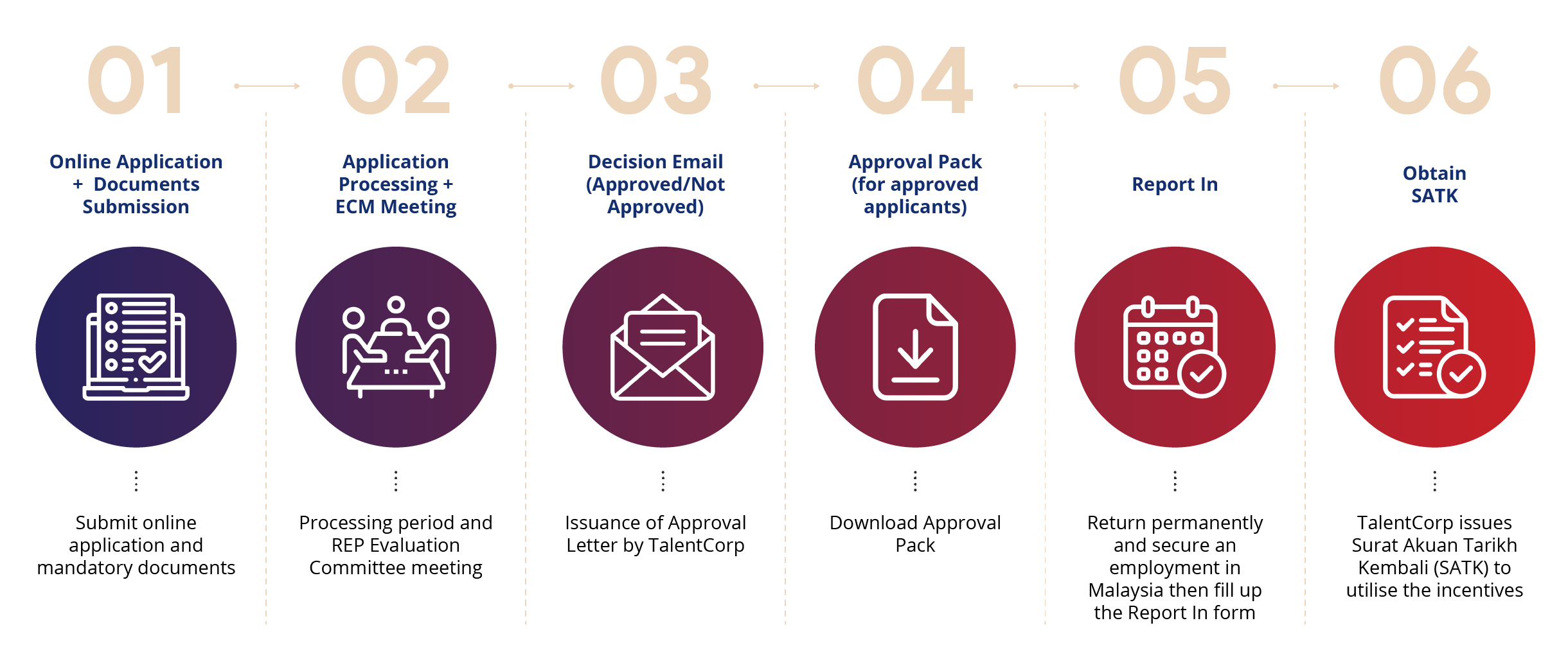

How to apply for the REP?

Application Procedure – General Guidelines

- You have to first register on MyHeart, then complete the REP application and upload all required documents as stipulated in the REP’s Terms and Conditions.

- Once your application is complete (including required documents), you will receive an acknowledgement email from the REP Secretariat. Your application will take approximately 45 working days to be processed. During this period, your application will be tabled to the REP Committee for consideration.

- The REP Committee will either approve or reject your application. You will receive a Decision Email from the REP Secretariat, informing you of the outcome.

- If your application is approved, you have a 2-year period from the date of the approval to return to Malaysia.

- Upon your return, you are required to fill up Report In form and provide further documents (listed in the Terms and Conditions) for confirmation. Once all documentations are in order, TalentCorp will issue a Surat Akuan Tarikh Kembali (“SATK”) in your favour.

- The SATK can be used to claim all REP incentives that you are eligible for.

Application Procedure – Required Documents

You will need the following documents for your application:

- A copy of your valid passport;

- A copy of your overseas residence document (permanent resident identity card, work permit or employment pass);

- Your latest resume (indicating years, months, and locations of current and previous employer(s));

- An offer letter or other equivalent agreement or document from your current employer (as proof of employment commencement date);

- Your latest salary slip (proof of employment at the time of application), or employment confirmation on join date, position, and salary;

- Your latest tax returns (salary reference if you have no fixed income);

- Your academic certificates that are certified by the Commissioner of Oath;

- Your employment offer letter or other equivalent agreement or document from Malaysia (if any);

- Valid and latest residing documents (proof of property ownership abroad and utility bills, or rental agreement and rental payment receipt) – only for applicants from Singapore, Thailand, and Brunei; and

- A copy of entry and exit stamps in your passport.

Additional documents for Self-Employed applicants

- Your business registration document (indicating when the business was established, and your names listed as the owner / board of director to the company);

- Your company’s bank statement for at least 6 months prior to the date of your submitted application, indicating receipt of payments to the business;

- A third-party confirmation that the business is still active until at least the time of your REP application from a company secretary, an external accountant, the Commissioner of Oath, or a Public Notary appointed by the government (to indicate that you are drawing an income at the time of application).

Doctors / Specialists

- Your complete registration certificate, duly approved by the Malaysian Medical Council (MMC). For registration, please refer to https://mmc.gov.my/

- Your complete registration certificate, duly approved by the National Specialist Registrar (NSR). For registration (specialists only), please refer to https://www.nsr.org.my/home.html

Dentist / Nurse / Other allied health practitioners

- Your registration from respective national professional bodies or regulators (e.g. Malaysian Nursing Board, Malaysian Dental Council).

Frequently Asked Questions (FAQ)

- General Enquiries

- REP Eligibility

- 15% Flat Tax Rate

- Tax Exemption on Car

- Family Benefits

- Tax Exemption on Personal Effects

- Inter-Company Transfer

- Miscellaneous

The Returning Expert Programme (REP) is a national programme by the Malaysian government to facilitate the return of Malaysian professionals to meet the talent needs of the nation, especially in the context of specific sectors identified as key to Malaysia’s economic transformation agenda.

You should apply 1-2 months before your expected date of return. If approved for the REP, you will be given a validity period of two (2) years to complete the following:

- Return to Malaysia

- Obtain employment

- Report to TalentCorp and obtain the Surat Akuan Tarikh Kembali

- Claim all benefits and incentives

Application to be submitted one to two months before your expected date of return to Malaysia, while you are still residing and employed abroad.

You may apply online. Once an application is complete and all documents have been submitted, the REP Secretariat will take up to 45 working days to process the application. After processing, applications will be tabled to the REP Evaluation Committee for their consideration. Applicants will be notified of the Committee’s decision (to approve or not to approve their application) within a few days of the REP Evaluation Committee meeting.

Yes, you may reapply as long as you still fulfill all the eligibility requirements. Alternatively, you may appeal for an extension of up to 1 year for your approval period, depending on the circumstances.

No, you are unable to reapply as applicants have to be working and residing abroad at the time of application.

Yes, you can reapply if you are still working and residing abroad and meet all the eligibility requirements.

Register your interest here if you would like to attend employment facilitation sessions with companies in Malaysia. These quarterly events are organised by TalentCorp.

Applicant must return to Malaysia, obtain employment and claim his/her REP incentives within 2 years of the validity period.

Approved applicants are given a 2-year validity period to return to Malaysia, obtain employment, report in to TalentCorp, and claim the incentives. Once applicants report in to TalentCorp with the necessary documents, they will receive the Surat Akuan Tarikh Kembali (SATK), which is necessary to claim REP incentives. The documents required for obtaining SATK are:

- Proof of commencing employment (permanent employment) in Malaysia e.g. Employment Contract and / or 1st Month’s Pay Slip or other similar documentation;

- Boarding Pass / Flight Tickets / e-ticket;Original Academic Certificates;

- International Passport.

Proof of return is required, for those travelling by car, we will either cite the return stamp on your passport or toll ticket during the travel.

Applicants may then use the ‘Surat Akuan Tarikh Kembali’ to claim the incentives and benefits offered under the REP:

- Optional 15% flat tax rate on chargeable employment income for a period of five (5) years continuously.

- Exemption on import duty and excise duty for the purchase of one (1) Complete Knocked Down (CKD) vehicle subject to the total duty exemption limited up to RM100k.

- Tax exemption for all personal effects* brought into Malaysia, limited to one (1) shipment *Personal effects don’t encompass motorised vehicles.

- The foreign spouse and children of an applicant (below 18 years old) will be eligible to apply for Permanent Resident (PR) status. Applicant and foreign spouse must be married prior to date of REP application submission. The procedure for Entry Permit issuance is subject to approval and at the discretion of the Director General of Immigration Department of Malaysia while the procedure for MyPR issuance is subject to approval and at the discretion of Director General of National.

- Registration Department of Malaysia. This PR status is only applicable for Peninsular Malaysia.

Barring unforeseen circumstances, application processing takes up to 45 working days upon complete submission of documents.

Please be aware that the processing period may be extended without prior notice, as this process involves coordination between TalentCorp and relevant government agencies and authorities.

Currently, there is no fee for the application of REP.

All applications and correspondence for REP approvals and claims of benefits and incentives will only be between TalentCorp, the applicant and relevant agencies. TalentCorp does not engage any agents to act on their behalf.

TalentCorp has a dedicated REP Helpdesk to answer your questions. They are contactable at +603 7839 7171 during regular office hours between Monday-Friday. Alternatively, you may email rep@talentcorp.com.my

TalentCorp organises employment facilitation events for approved REP applicants and companies who are actively hiring in Malaysia.

If you would like to attend these (or other events for REP applicants), register your interest here.

The REP Committee is currently chaired by TalentCorp and represented by other ministries and agencies, including but not limited to the Ministry of Finance, Inland Revenue Board, Immigration Department, Ministry of Foreign Affairs, Ministry of Home Affairs, and others. TalentCorp acts as the Secretariat for the Returning Expert Programme.

TalentCorp adheres to the confidentiality policy and will never divulge applicants’ personal information to third parties, without prior approval from applicants.

You may get in touch with the REP Secretariat by emailing rep@talentcorp.com.my

There is no restriction for leaving the country. However, LHDN audit may find that your tax filing does not follow the expected procedure, in which case the tax incentive will be terminated. To avoid unforeseen problems, we strongly recommend that you inform LHDN about your plans to leave the country.

The REP is a programme by the Malaysian government and subject to revision without prior notice.

TalentCorp organises education facilitation events for approved REP applicants, with private and international schools in Malaysia. Kindly refer to our Education for Your Children page for more information.

No, TalentCorp and the Government of Malaysia do not have any jurisdiction on where the applicants want to enroll their children. It is up to the applicants to enroll their children in any school of choice.

REP applications have to be made while applicants are residing and working overseas. This is one of the eligibility requirements; any application submitted after an applicant has returned to Malaysia will not be approved by the REP Evaluation Committee.

To be eligible for the REP, applicants must meet the following criteria:

- Is a Malaysian citizen

- Is currently residing abroad and has been employed abroad continuously for a minimum of three years at the time of REP application

- Has not earned employment income in Malaysia continuously for a minimum of three years prior to REP application

- REP Application is made prior to returning to Malaysia.

- Applicant does not hold any outstanding scholarship bond or loan with the Malaysian government and its agencies.

- The applicant is under no obligation to return to Malaysia (if returning with the same company).

*Please note that REP applications should be submitted while the applicant is still residing and working abroad. Submissions made by applicants upon their return to Malaysia will not be considered.

While it is not mandatory, we would appreciate if you keep us updated on your current employment within the 5 years’ timeframe.

We regret that you will not be eligible.

REP applications have to be made while applicants are residing and working overseas. This is one of the eligibility requirements; any application submitted after an applicant has returned to Malaysia will not be approved by the REP Evaluation Committee.

The Committee’s approval is based on the guideline on eligibility criteria.

The REP is only applicable for Malaysian citizens who are still working and residing abroad at time of application.

The REP is only applicable for Malaysian citizens who are still working and residing abroad at time of application.

As per the Ministry of Health’s directive, all medical graduates without prior clinical experience are not eligible for the REP.

An approved REP applicant who has received the SATK is not eligible to reapply a second time. The issuance of REP SATK and availability of REP incentives is only valid for one (1) time application per approved REP applicant.

The 15% Flat Tax Rate is ‘optional’ as an REP applicant can choose to apply this incentive to their tax returns, or not. Once opted for, this 15% Flat Tax Rate will be for a continuous period of 5 years. If an applicant chooses not to utilise this incentive within 2 years (the year of return or the year after), the applicant will not be able to claim this incentive in the future.

Kindly refer here for Lembaga Hasil Dalam Negeri’s (LHDN) individual tax brackets.

Keep in mind that the following is an estimate based on an example, and the actual amount will vary due to personal tax reliefs taken, additional income, and other factors.

Example of a married applicant:

Applicant earns RM 15,000 monthly income

Annual income = RM180,000 (RM15,000 x 12)

Tax reliefs taken = RM13,000 (RM9,000 for Individual + RM4,000 for Spouse)

Chargeable Income = RM167,000 (RM180,000 – RM13,000)

A) Regular tax rate calculation (at 2021 rate, non-REP):

| On the First 100,000 | 10,700 | |||

| G | 100,001 – 250,000 | Next 150,000 | 24 | 36,000 |

*Income tax bracket taken from LHDN’s website

In this example, chargeable income is RM167,000 and qualifies for this tax bracket above.

Annual tax = RM10,700 + (24% x (167,000 – 100000)) = RM26,780

B) REP 15% flat tax calculation:

Chargeable Income x 15%

RM167,000 x 15% = RM25,050

In the example above, the 15% flat tax rate is lower than the regular tax rate. For more information, please contact LHDN.

Assuming you are approved for the REP, you will receive a 2-year validity period during which time you can make your choice and claim this incentive. Within this period, it is assumed that you obtain employment and return to Malaysia. Your validity period will lapse after 2 years; this means after 2 years you will not be eligible to claim the tax incentive, should you decide to do so.

There are two (2) steps to utilise the 15% flat tax rate incentive:

Firstly, the employer can deduct Potongan Cukai Bulanan (PCB) at the rate of 15% from the applicant’s monthly salary once employment has started.

Secondly, the applicant must file their tax individually using the e-BT form for the next five (5) years. They are given the option to start using the 15% flat tax rate on their first year of employment or in the next consecutive year, as stated in the Surat Akuan Tarikh Kembali (SATK).

Approved REP applicants are allowed to establish their own business but will not be eligible for the 15% flat tax rate if they are drawing a business income. The exception here is if they are drawing a fixed employment income from the business. Kindly refer to the REP Helpdesk for more information.

Once you have purchased your CKD vehicles tax-free, you must have them in possession for a minimum period of two (2) years before you are allowed to sell them off to a third party.

In the event the approved Applicant intends to sell the vehicle after the 2-year period, then the approved Applicant is required to obtain prior approval from Ministry of Finance and pay the remaining duties and/or taxes to the Royal Malaysian Customs Department prior to the sale. Please refer to the Ministry of Finance for more information on this.

Vehicles cannot be sold or its ownership transferred (penukaran hak milik) without paying excise duty and sales tax calculated by the Royal Malaysian Customs during the sale or ownership transfer.

To purchase CKD vehicles under the REP, returnees will have to approach a car dealer with a copy of their Surat Akuan Tarikh Kembali and Approval Letter.

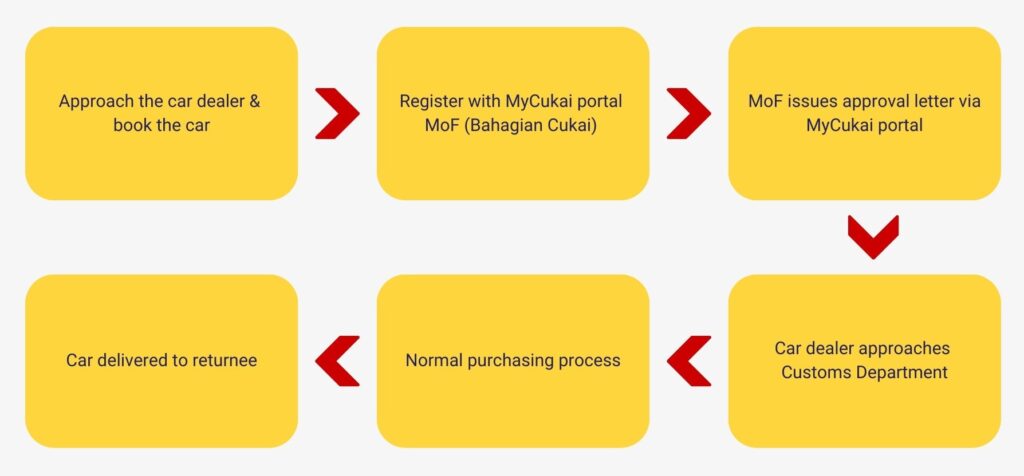

Here are the steps to claiming the CKD vehicle incentive:

- Make a booking, and get the chassis number and engine number from the car dealer

- Once the information is available, you may proceed with a tax exemption application.

- Visit the MyCukai portal and register for an account.

- The Ministry of Finance (MoF) will process the tax exemption and issue the Tax Exemption letter (stating the car’s chassis and engine number). The car dealer must bring the letter to the Customs department for endorsement. After that, it reverts to a normal purchasing process.

Taxes will differ based on the make, model, engine capacity, and car dealer’s profit margin.

Approved REP applicants may refer to the Customs Department for the exact tax amounts. TalentCorp does not have this information.

Approval of excise duty and sales tax will be withdrawn if recipient violates any of the conditions contained in the approval letter from TalentCorp. This means applicants will be charged full duties and taxes on the car if it is sold within a 2-year period.

Applications would have to be submitted individually and if approved, each applicant is eligible for one car.

- Applicant must obtain a valid Approval Letter, Surat Akuan Tarikh Kembali and support letters from Talent Corporation Malaysia Berhad (TalentCorp).

- Application can ONLY be submitted at Immigration Department Headquarters in Putrajaya.

For more information on the MyPR application procedure, applicant may refer to: https://rep.talentcorp.com.my/what-you-need-to-know/how-to-apply-for-rep-benefits

Foreign spouse and children (below 18 years old) of the approved applicant (if any) is recommended to apply for the Long Term Social Visit Pass (LTSVP) on the same day of Entry Permit application at the Immigration.

Applicant may walk-in to the Immigration Office for the Entry Permit submission and refer to Immigration’s website on the operation hours.

For Entry Permit application process at Immigration, related documents are:

- Borang Permohonan Permit Masuk IM.4 Pin1/93 can be obtained from TalentCorp

For Permanent Resident (MyPR) application process at National Registration Department (JPN), related documents are:

- MyPR application form JPN.KP01.

*We encouraged applicant to engage directly with Bahagian Visa, Pas dan Permit, Jabatan Imigresen Malaysia if there is any further enquiries on the required documents prior to your visit to Immigration for a smoother process.

The Entry Permit application will take 6 months or longer to be processed by the Immigration department upon complete submission. Therefore, your foreign spouse and children are recommended to apply for LTSVP as a valid pass to stay in Malaysia while waiting for the decision on the PR as LTSVP can be granted sooner.

However, TalentCorp cannot make any guarantees as to the success or timeline of this process. Application for Entry Permit will be processed at the discretion of the Immigration Department of Malaysia.

TalentCorp cannot provide any guarantee for the success of the application as it is subject to approval and at the discretion of the Director General of the Immigration Department of Malaysia.

Applicant may check on the status of the application at the link below;

https://imigresen-online.imi.gov.my/eservices/myPermit?semakStatusPermit

Note:

- Please remove the icon “/” from the original reference no. ‘No. Rujukan’ when you fill up the form (e.g. EPW121XXXXXX)

- ‘Penaja’ Sponsor is referring to approved REP applicant.

We encouraged applicant to engage directly with Bahagian Visa, Pas dan Permit, Jabatan Imigresen Malaysia for further advice.

One of the REP benefits is that a foreign spouse and children may be eligible for Permanent Residence (MyPR) status, subject to approval and at the sole discretion of the Immigration Department of Malaysia. TalentCorp cannot make any guarantees as to the success or timeline of this process. Please be informed that in the case of a PR application for your spouse, you would need to be legally married (and officially registered in Malaysia) at the time of your REP application. This process could take some time.

For non-married partners, please be informed that you can go through the standard (non-REP) pass applications at Jabatan Imigresen Malaysia Long Term Social Visit Pass (LTSVP) for now, and if your partner would like to work in Malaysia, they will need to be hired by a company and get an employment pass (applied for by the company).”

The PR Incentive offered by the REP is only applicable for those residing in Peninsular Malaysia. For Sabah and Sarawak, foreign spouses and children of applicants must reside in Sabah and Sarawak for at least five (5) years before being eligible for PR status.

In your case, it is our understanding that your spouse will have to reside in Sabah or Sarawak for at least five (5) years before applying for PR status. However, we advise you to check with the Sabah/Sarawak immigration office on their procedures, as well as any changes in criteria for PR applications. TalentCorp has no jurisdiction over immigration matters.

Your personal effects are the goods kept by you or your immediate family for household or personal use. It encompasses electrical goods, furniture and fittings and other household items. Motorised vehicles and taxable items, such as alcohol, cigarettes and tobacco, do not fall under the category of personal effects. All items should have been in your possession and used for a period of not less than three months.

It is best done in parallel, i.e. you should return to Malaysia and ship your personal effects at the same time. Upon your return, employment and obtainment of your ‘Surat Akuan Tarikh Kembali’, you may then claim your tax-free personal effects. However, kindly note that this incentive would only apply for the first shipment and any other subsequent shipments may be subjected to taxes.

Eligibility will depend on the following:

- Whether you were sent abroad on assignment/secondment;

- Whether there was an understanding that you would return to Malaysia to a ready position within the same group;

- Whether you were/are obligated to return to Malaysia; and

If the answer to any of the above is YES, you may not be eligible for the REP.

If the answer to all of the above is NO, you may be eligible, subject to a full evaluation and documentation review.

However, in line with MOF’s latest policy clarification, if you have served at least five (5) consecutive years abroad within the same corporate group, your REP application may be considered.

The MOF requires applicants to have served at least five (5) consecutive years abroad within the same corporate group in order to qualify for REP consideration.

Such applications may be submitted to the MOF for case-by-case consideration, pursuant to Section 127(3A) of the Income Tax Act 1967.

Applicant who wish to bring back their pets, would have to comply with the regulations under Customs and Department of Veterinary Services Malaysia. Please browse the following website for further details: https://www.dvs.gov.my/